本文转自《Huffpost》发表的题为“Here’s A Radical New Plan To Tax Carbon And Give Everyone In America $2,237”的报道。

作者:Alexander C. Kaufman

日期:2018.09.19

原文链接:https://www.huffingtonpost.com/entry/carbon-tax-plan_us_5b9fcb35e4b013b0977d45c6

It’s a moonshot proposal to shift the debate on the one climate policy both political parties seem to see as inevitable.

这是一个不切实际的提议,旨在改变两党似乎都认为不可避免的一项气候政策的辩论。

BRIAN SNYDER / REUTERS

At a time when unprecedented storms and wildfires are wreaking record destruction, figuring out the cost of how much damage carbon dioxide emissions cause is a game of “The Price Is Right.”

在前所未有的风暴和野火造成破纪录的破坏时,弄清楚二氧化碳排放造成多大程度损害的成本是一场“价格合适”的游戏。

The two Republican congressmen pushing a bill to put a price on planet-warming emissions wants to tax carbon at $24 per ton. Four Democratic lawmakers pegged the price at $50 per ton in their own legislation. The Trump administration, for its part, settled on something more lower: $1 to $7 per ton by 2020.

两位共和党国会议员推动一项法案,对地球变暖排放定价,要求每吨24美元的碳税。 四位民主党议员在自己的立法中将价格定为每吨50美元。 就特朗普政府而言,它采取了更低的措施:到2020年每吨1至7美元。

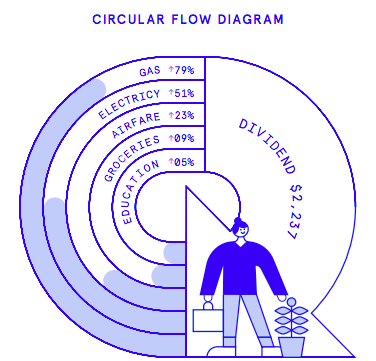

But to really make a difference, a better answer is something closer to $230 per ton, according to a study by the People’s Policy Project, a left-leaning think tank, published Wednesday. That would raise the cost of goods and services by roughly $750 billion, including price hikes of 79 percent for gas, 51 percent for electricity, 23 percent for airfare and 9 percent for groceries.

但周三公布的People's Policy Project的一项研究表明,要真正发挥作用,更好的答案是接近每吨230美元。 这将使商品和服务的成本大约增加7500亿美元,其中包括天然气价格上涨79%,电力价格上涨51%,机票价格上涨23%,杂货价格上涨9%。

“People are going to feel that,” co-author Anders Fremstad, an assistant professor of economics at Colorado State University, said in a phone interview. “And the people who will feel that the most are going to be poor people.”

科罗拉多州立大学(Colorado State University)经济学助理教授安德斯•弗雷斯塔德(Anders Fremstad)在接受电话采访时说:“人们会有这种感觉。” “那些会觉得最多会成为穷人的人。”

That’s where the paper’s most radical proposal comes in: offsetting that cost by paying every person in the United States $2,237 per year.

这就是该论文最激进的提案所在的地方:通过向美国每个人每年支付2,237美元来抵消这笔费用。

“It forces the well-to-do to pay their fair share,” said Fremstad, who wrote the paper with New College of Florida assistant professor Mark Paul. “And they pollute far more.”

Fremstad在佛罗里达州新学院助理教授马克保罗撰写论文时说:“这迫使富人付出了相当大的份额。” “而且他们污染更多。”

PEOPLES POLICY PROJECT

A chart from the 23-page white paper illustrates how much a $230 per ton carbon tax would raise consumer prices.

这份23页的白皮书中的图表说明了每吨碳税230美元会提高消费者价格。

Support for a carbon tax is higher than the limited policy debate in Washington suggests. A study published last October in the journal Environmental Research Letters found the average American would willingly spend $177 per year on a carbon tax, raising electricity prices by about 14.4 percent compared to current electricity rates in each state. Even oil giant Exxon Mobil Corp., a longtime financier of climate change denial think tanks, said it would support a (relatively low) carbon tax.

对碳税的支持高于华盛顿有限的政策辩论。去年10月发表在“环境研究快报”上的一项研究发现,美国人平均愿意每年花费177美元购买碳税,与每个州目前的电费相比,电价上涨约14.4%。甚至石油巨头埃克森美孚公司(Exxon Mobil Corp.)也是气候变化拒绝智囊团的长期金融家,他表示将支持(相对较低的)碳税。

The economists in the new study picked the $230 figure somewhat arbitrarily. It’s the number that Yale University economist William Nordhaus identified as the price that would most likely keep the planet from warming 2.5 degrees Celsius above pre-Industrial Revolution levels. That exceeds the 2 degrees Celsius target set by the Paris climate accord, but Fremstad said the goal of the paper is to meaningfully shift the policy debate over a carbon tax away from double-digit prices that would do little to incentivize a total overhaul of the nation’s energy system.

新研究中的经济学家有点随意地选择了230美元的数字。这是耶鲁大学经济学家威廉诺德豪斯确定的最有可能让地球在工业革命前的水平上升2.5摄氏度的价格。这超出了巴黎气候协议设定的2摄氏度目标,但Fremstad表示,该文件的目标是有意义地将关于碳税的政策辩论从两位数的价格转移到两位数的价格,这对激励全面彻底改革不会产生任何影响。国家的能源系统。

“I don’t think it’s practical that policymakers are going to come around and immediately do a $230 tax per ton, but it’s in the order of magnitude we need to be thinking about,” he said. “Progressives should double down on the policy and say we want a much higher one.”

他说:“我认为政策制定者不会出现这种情况并且每吨立即支付230美元的税,这是不切实际的,但这是我们需要考虑的数量级。” “进步人士应该加倍对政策,并说我们想要更高的政策。”

Even a carbon price twice as high as Fremstad’s proposal would not avert the catastrophic forecasts for how the climate will change once the planet warms beyond 2 degrees Celsius. A United Nations study last year found that a carbon price of $573 per ton, paired with a resource extraction tax and rapid technological innovation, would still lead to 132 billion metric tons of CO2 by 2050, according to a recently-published Foreign Policy essay arguing that economic growth itself cannot be green.

即使碳价高出 Fremstad的两倍,也无法避免一旦地球变暖超过2摄氏度,气候将如何变化的灾难性预测。 根据最近公布的外交政策论文,联合国去年的一项研究发现,每吨573美元的碳价,加上资源开采税和快速的技术创新,到2050年仍将导致1320亿公吨的二氧化碳排放量。 经济增长本身不可能是绿色的。

For his part, Fremstad said “there’s no reason to think” his proposal “would slow down growth.”

Fremstad表示,“没有理由认为”他的提议会“减缓增长”。

It forces the well-to-do to pay their fair share. And they pollute far more.

——Anders Fremstad, Colorado State University

它迫使富人支付他们应得的份额,他们污染得更多。

——安德斯弗雷姆斯塔德,科罗拉多州立大学

“This would redirect technology innovation from the next form of fracking to solar and wind and mass transit,” he said. “We’re trying to change the structure of the economy, but not the speed at which it grows.”

“这将把技术创新从下一种水力压裂方式转向太阳能,风能和公共交通,”他说。 “我们试图改变经济结构,但不是改变经济增长的速度。”

But he said an ambitious, three-digit carbon tax is just one of a suite of policies needed to reduce surging emissions from burning fossil fuels, deforestation and industrial farming. Progressive candidates and policy advocates over the past year have rallied around various emissions-curbing proposals, including a Green New Deal, a fiscal stimulus plan to potentially spend trillions on renewable energy and home weatherization in an infrastructure-building spree not seen since World War II. But Fremstad warned that funding such a plan with a carbon tax risks exacerbating economic inequality at a time when the British charity Oxfam estimates the average person in the top 1 percent already creates 175 times more carbon pollution.

但他表示,雄心勃勃的三位数碳税只是减少燃烧化石燃料,砍伐森林和工业化农业所产生的排放所需的一系列政策之一。 过去一年中,进步的候选人和政策倡导者围绕各种限制排放的提议,包括绿色新政,可能在可再生能源上投入数万亿美元的财政刺激计划以及自第二次世界大战以来未见过的基础设施建设狂潮中的家庭风化。 但弗雷姆斯塔德警告称,在英国慈善机构Oxfam估计,前1%的普通人已经创造了175倍的碳污染时,为这样的碳税计划提供资金可能会加剧经济不平等。

“If we give all the money back to people in lump-sum payments, it’s sort of sweetener that can make the policy politically viable,” he said. “We’ll need money for public projects, too, but that money should be raised through progressive taxation and public borrowing like it always should be for big public projects.”

他说:“如果我们把所有的钱全部还给人们一次性支付,那就是可以使政策在政治上可行的甜味剂。” “我们也需要资金用于公共项目,但这笔资金应该通过累进税收和公共借贷来筹集,就像大公共项目一样。”

Of course, carbon pricing still faces considerable opposition. In July, the House of Representatives voted 229-180 to pass a resolution formally declaring a carbon tax “detrimental” to the U.S. economy. Grover Norquist, an anti-tax crusader with influence on the GOP, has railed against carbon pricing schemes. The political trends are true north of the U.S. border, too. Doug Ford, the newly-elected right-wing populist premier of Ontario, Canada’s largest province, vowed to scrap plans for a carbon tax he called “no more than government cash grab.”

当然,碳定价仍面临相当大的反对意见。 7月,众议院以229-180票通过决议,正式宣布对美国经济“有害”的碳税。 Grover Norquist是一位对共和党有影响力的反税斗士,他反对碳定价计划。 美国边境的政治趋势也是如此。 加拿大最大省份安大略省新当选的右翼民粹主义总理道格福特发誓要废除碳征税计划,他称之为“不超过政府现金攫取”。